In today’s uncertain economic climate, many investors look to diversify and protect their retirement savings by adding tangible assets to their portfolios. Goldco helps individuals incorporate precious metals—primarily gold and silver—into self-directed IRAs and other retirement accounts to hedge against inflation, currency devaluation, and stock market volatility. This guide explains what Goldco offers, how their precious metals IRA process works, and the key questions to ask before you move retirement funds into physical metals.

What is Goldco?

Goldco is a privately held company that helps investors add precious metals—primarily gold and silver—into retirement accounts. Founded in 2006 and based in Woodland Hills, California, Goldco focuses on self-directed precious metals IRAs and direct precious metals purchases, guiding clients through rollovers, custody, and secure storage.

Over its years in business, Goldco has positioned itself as an education-forward provider: the company offers resources and one-on-one support to help investors understand how metals can protect retirement savings from inflation, currency shifts, and stock-market volatility. Goldco has also been recognized for fast growth, appearing on the Inc. 5000 list in multiple years (see source pages for specific years and figures).

Affiliate Disclosure: We may receive compensation if you use the links in this article. This is at no additional cost to you. We only recommend products we believe will add value to our readers.

Protect Your Retirement Savings

Get a step-by-step IRA rollover checklist and practical guidance for moving retirement funds into a precious metals IRA with Goldco’s free guide.

Services Offered by Goldco

Goldco provides a set of services for investors who want exposure to precious metals—either inside a retirement account or through direct purchases. Understanding these options will help you decide which path fits your financial goals and timeline.

Precious Metals IRAs

Goldco specializes in helping clients set up self-directed precious metals IRAs that hold IRS-approved gold and silver coins or bars. The company assists with the full IRA process—selecting a custodian, completing rollover or transfer paperwork, funding the account, choosing IRA-eligible metals, and arranging approved storage—so investors retain the tax advantages of a traditional or Roth IRA while holding physical metals.

Typical rollover and transfer sources supported include:

- Traditional IRAs

- Roth IRAs

- 401(k) plans

- 403(b) plans

- Thrift Savings Plans (TSPs)

- 457 plans

Quick checklist for the IRA onboarding process: 1) Schedule an initial consultation with a Goldco representative, 2) select a custodian and complete account forms, 3) initiate a trustee-to-trustee rollover or transfer, 4) choose your IRS-approved metals, and 5) confirm secure depository storage.

Direct Purchase of Precious Metals

If you prefer immediate ownership outside an IRA, Goldco also sells gold and silver coins and bars for direct purchase. Direct purchases offer flexibility—metals can be delivered to your home (subject to eligibility and insurance limits) or stored in a secure depository. This option avoids IRA rules but does not provide the tax advantages of retirement accounts.

Buyback Program

Goldco offers a buyback program that enables customers to sell metals back to the company when they choose to liquidate. Buyback prices are typically tied to current market rates; terms, timing, and any applicable fees should be confirmed with Goldco prior to sale. The buyback program is designed to simplify liquidation compared with selling on the open market.

Goldco’s Precious Metals Selection

Goldco offers a range of IRS-approved precious metals for inclusion in self-directed IRAs, as well as coins and bars for direct purchase. Generally, IRA-eligible gold must meet a minimum purity (commonly 99.5% for many accepted gold products) and silver items usually meet 99.9% purity standards; confirm specific eligibility for each product before purchase.

Gold Products

Common gold options available through Goldco include widely recognized bullion and legal-tender coins that tend to carry strong liquidity in the market:

- American Eagle Gold Coins

- American Buffalo Gold Coins

- Canadian Maple Leaf Gold Coins

- Australian Gold Coins

- Gold bars in various weights

Silver Products

Popular silver choices include government-minted coins and silver bars, which are often used to increase a portfolio’s gold-silver balance:

- American Eagle Silver Coins

- Canadian Maple Leaf Silver Coins

- America the Beautiful Silver Coins

- Lucky Dragon Silver Coins

- Silver bars in various weights

Notes on selection and liquidity: government-minted coins (American Eagle, Canadian Maple Leaf) typically trade with narrower premiums over spot and are more liquid than some specialty coins; bars often offer lower premiums per ounce but may be less convenient for small sales. Premiums, availability, and IRA eligibility can change — always confirm the product’s purity, IRA-eligibility, and current price before purchase.

Setting Up a Goldco Precious Metals IRA

Opening a precious metals IRA with Goldco is a multi-step process designed to keep your retirement account compliant with IRS rules while adding exposure to physical gold and silver. Goldco provides guidance at each stage—consultation, paperwork, funding, metal selection, and secure storage—so you know what to expect and how long each step typically takes.

Step 1: Initial Consultation

Start with a consultation with a Goldco representative to discuss your retirement timeline, risk tolerance, and whether a precious metals IRA fits your goals. This call is the time to ask about fees, storage options, IRA-eligible products, and any current promotions or offers.

Step 2: Account Setup

If you decide to proceed, Goldco helps you establish a self-directed IRA with a qualified custodian. The custodian is the trustee who administers the account and handles required paperwork (IRA application, W-9, transfer/rollover forms). Goldco frequently works with established custodians, but you can confirm current partners with your representative.

Step 3: Fund Your Account

Fund your metals IRA via one of these methods:

- Trustee-to-trustee rollover from a 401(k) or other employer plan

- Transfer from an existing Traditional or Roth IRA

- New annual IRA contribution (subject to IRS contribution limits)

Goldco assists with the transfer and rollover paperwork to reduce the risk of taxable distributions; direct trustee-to-trustee transfers typically avoid immediate tax consequences. Typical timelines for rollovers/transfers vary but often take 2–6 weeks depending on the source account and custodian responsiveness.

Step 4: Select Your Metals

Once funded, you and your Goldco representative select IRS-approved metals for your IRA. Goldco will present IRA-eligible gold and silver coins and bars that meet purity requirements; your rep can explain liquidity, premiums, and how each option fits your allocation strategy.

Step 5: Secure Storage

IRS rules require that IRA-owned metals be held in an approved depository. Goldco partners with secure depositories (for example, the Delaware Depository and Brinks have been used historically) to provide insured storage in either segregated or non-segregated facilities. Segregated storage keeps your metals physically separate (typically higher cost); non-segregated storage pools holdings but still tracks ownership individually. Ask your representative for current depository options, insurance details, and storage fee ranges.

Claim Your Free Silver

Goldco sometimes offers free silver on qualifying purchases—for example, promotional packages that add a percentage of free silver on large IRA-funded purchases. Confirm eligibility, offer limits, and expiration dates with your representative before relying on promotions.

Goldco Fees and Minimums

Fees and minimums are important when evaluating a precious metals IRA because they affect your net returns and the break-even point for diversification. Below is an overview of typical costs associated with a Goldco precious metals IRA; confirm current rates with Goldco or your chosen custodian before you invest.

Account Setup and Maintenance

Expect a one-time account setup fee to establish a self-directed IRA and annual maintenance or administration fees charged by the custodian. In many cases the custodian bills the annual fee directly, while Goldco may charge onboarding or service fees. Typical ranges (as of the last available public data) are:

- One-time setup fee: commonly $50–$200

- Annual custodian/admin fee: commonly $75–$300 per year

Who pays what: setup and admin fees are usually billed to the IRA account (via the custodian), while any advisory or service fees from Goldco may be billed separately — ask your representative for a fee schedule and how fees will be collected.

Storage Fees

IRA-owned metals must be stored in an approved depository and incur storage fees. Fees vary by depository and by storage type:

- Non-segregated (commingled) storage: lower annual fees — commonly $50–$150/year

- Segregated (individual) storage: higher annual fees — commonly $100–$350/year

Storage fees may include insurance or require separate insurance coverage; confirm coverage limits and whether bullion is fully insured while in transit or at rest.

Buyback and Transaction Costs

When you sell metals back to Goldco or elsewhere, expect transaction costs or spreads between buy and sell prices. Buyback offers are usually based on spot market prices minus a margin; confirm any fees or commissions that apply to liquidation.

Investment Minimums

Goldco commonly sets minimums for opening a precious metals IRA and for some promotional packages. Typical figures reported publicly are:

- IRA minimum (typical): around $25,000

- Direct (non-IRA) purchases: often lower minimums, commonly $5,000–$10,000

Minimums can vary by promotion and over time — always verify current minimums with Goldco before starting the process.

How Fees Affect Returns

Fees reduce net returns over time. As an example, a 1% annual fee on a $50,000 metals allocation is $500 per year; when comparing options, run simple projections that include setup, storage, and annual custodian fees to see how they affect long-term savings.

Because specific fee schedules and storage pricing change, include a dated note in your published copy (for example, “Fees accurate as of [Month Year]”) and link to the official fee schedule or request a current quote from Goldco or the custodian.

Goldco’s Reputation and Trustworthiness

Reputation matters when you’re entrusting a company with retirement assets. Goldco has built a strong presence in the precious metals industry, emphasizing customer support, education, and regulatory compliance.

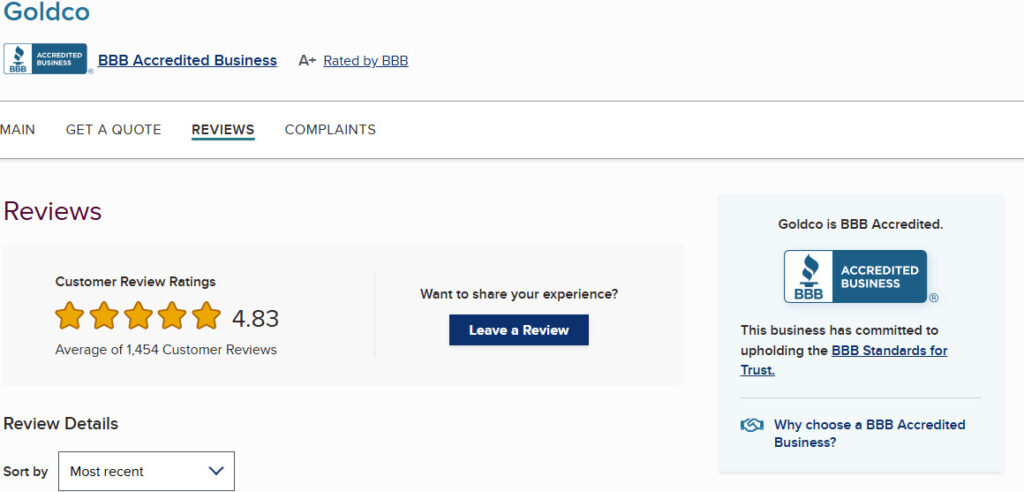

Ratings and Reviews

Goldco maintains an A+ rating with the Better Business Bureau (BBB) and has received positive customer feedback across review platforms. Review scores and counts change over time—link to the company’s current BBB and Trustpilot pages when publishing to show up-to-date ratings and review volume. When checking reviews, look for common themes (customer service responsiveness, clarity of fees, and ease of rollovers) and note any recurring complaints and how the company resolved them.

Industry Recognition

Goldco has been recognized for business growth in industry rankings such as the Inc. 5000 in multiple years, reflecting expansion and demand for its services. Cite specific years and sources in the final article to support this claim.

Regulatory Compliance

Goldco works with IRS-approved custodians and approved depositories to maintain compliance for precious metals IRAs. That custodial and depository relationship is an important part of trustworthiness—confirm the current custodian partners and depository arrangements (and link to their credentials) before publishing.

How to Vet a Precious Metals Company

- Check BBB ratings and accreditation, and read complaint details.

- Read third-party review platforms (Trustpilot, Google) and look for patterns in customer feedback.

- Confirm custodians and depositories the company uses and verify their credentials.

- Ask for a clear fee schedule and written documentation of buyback and storage policies.

Pros and Cons of Investing with Goldco

Advantages of Goldco

- Strong reputation and positive customer reviews. Goldco scores well on third‑party review platforms and maintains BBB accreditation, which can reassure prospective customers.

- Comprehensive educational resources. The company provides guides and one‑on‑one support to help new investors understand precious metals and gold IRA mechanics.

- Dedicated representatives. Customers often work with a single representative through the rollover and purchase process, simplifying communication and paperwork.

- Buyback program. Goldco’s buyback option makes liquidation easier than selling on the open market; buyback prices are generally market‑based but confirm any spread or fees up front.

- Promotions and offers. Periodic incentives (for example, free silver on qualifying purchases) can reduce effective costs for some customers—always confirm terms and eligibility.

- Experience with rollovers and custodial partnerships. Goldco handles rollovers from multiple retirement accounts and partners with established custodians and depositories for storage and compliance.

Potential Drawbacks

- Higher minimums for IRAs. Typical precious metals IRA minimums are often around $25,000, which is higher than some competitors and may exclude smaller investors.

- Storage and maintenance fees. Custodian and depository fees (setup, annual admin, and storage) add to costs and reduce net returns over time—run projections before you commit.

- Limited metals selection. Goldco focuses primarily on gold and silver; investors seeking platinum or palladium may need another provider.

- Physical metals don’t generate income. Unlike dividend stocks or bonds, bullion provides price appreciation potential but no yield.

- Extra steps for IRA distributions. Taking physical possession or liquidating IRA metals can involve tax consequences and additional processing—consult a tax advisor.

Which profile fits Goldco?

- Best for: Investors with at least $25k who want an inflation hedge, strong customer support, and easier liquidation via buyback.

- Not ideal for: Investors seeking small-ticket purchases, regular income from investments, or a wide range of metals beyond gold and silver.

If you’re unsure whether a precious metals IRA is right for you, request a free consultation to discuss your options, compare costs, and get a personalized recommendation based on your retirement goals.

How Goldco Compares to Alternatives

Comparing Goldco to other precious metals dealers and to traditional retirement account options can help you determine which path best fits your savings goals and budget.

Goldco vs. Other Gold IRA Companies

| Feature | Goldco | Augusta Precious Metals | American Hartford Gold |

| Minimum Investment | $25,000 (IRA) | $50,000 | $10,000 |

| BBB Rating | A+ | A+ | A+ |

| Metals Offered | Gold, Silver | Gold, Silver | Gold, Silver, Platinum |

| Buyback Program | Yes | Yes | Yes |

| Special Offers | Free silver on qualifying purchases | Free educational webinars | First-year fees waived on qualifying purchases |

Note on interpreting minimums: advertised minimum investments often reflect standard IRA packages; promotions or waived fees may temporarily lower effective thresholds. Always confirm current minimums, fee waivers, and qualification rules with each company before deciding.

Goldco vs. Traditional Retirement Accounts

Precious metals IRAs offer different trade-offs compared with traditional retirement accounts invested in stocks and bonds:

Precious Metals IRAs (Goldco)

- Physical assets that can hedge against inflation

- Potential protection during economic downturns

- Low correlation with stock-market performance

- Additional fees for storage, custodial administration, and possible buy/sell spreads

- Do not generate income (no dividends or interest)

Traditional Retirement Accounts

- Typically invested in stocks, bonds, ETFs, and mutual funds

- Potential for higher long-term growth and income generation through dividends and interest

- More exposure to market volatility

- Generally lower direct custody/storage fees

At-a-glance: Goldco is a solid option for investors with at least $25k who want direct exposure to gold and silver, a dedicated support experience, and an easier liquidation path via buyback. If you prioritize lower minimums, income generation, or a wider metals menu, compare alternatives and traditional accounts to find the best fit for your retirement strategy.

Frequently Asked Questions About Goldco

Is Goldco a legitimate company?

Yes. Goldco is an established precious metals company that has been in business for several years and works with IRS‑approved custodians and approved depositories to offer compliant precious metals IRAs. The company holds third‑party ratings and customer reviews that you should verify at publication time (for example, check the Better Business Bureau and Trustpilot pages for current scores and review counts).

What is the minimum investment required for Goldco?

Typical precious metals IRA minimums reported are around ,000, while direct (non‑IRA) purchases often have lower thresholds (commonly ,000–,000). Minimums and promotional offers can change, so contact Goldco for current account minimums and qualification details.

How does Goldco’s buyback program work?

Goldco offers a buyback option that lets customers sell precious metals back to the company. Buyback prices are typically based on current market spot prices less any applicable spreads or fees. If you plan to liquidate IRA-held metals, you can request a distribution in cash (avoiding physical delivery tax complications) or take physical delivery upon meeting distribution rules—confirm timelines, price calculations, and any fees with Goldco in advance.

Can I take physical possession of the metals in my Goldco IRA?

While your IRA is active, IRS rules require metals to be held in an approved depository. When you become eligible for distributions (typically age 59½ or older), you may choose to take possession of the metals; that distribution may have tax consequences. Alternatively, you can have Goldco or the custodian sell the metals and distribute cash. Consult a tax advisor for specific tax implications before taking physical delivery.

What types of retirement accounts can be rolled over to a Goldco precious metals IRA?

Goldco can assist with rollovers and transfers from common retirement accounts including Traditional IRAs, Roth IRAs, 401(k) plans, 403(b) plans, 457 plans, and Thrift Savings Plans (TSPs), as well as certain employer plans. Rollovers typically use trustee‑to‑trustee transfers to avoid taxable distributions; timelines vary but often take several weeks. Confirm eligibility for your specific plan with Goldco and your plan administrator.

How are storage fees billed and is my investment insured?

Storage fees are charged by the depository (and sometimes billed through the custodian) and vary by storage type (segregated vs. non‑segregated) and depository. Many depositories include insurance in their storage fees, but coverage limits and terms differ—confirm what is covered during transit and at rest. Request a written fee and insurance summary before finalizing your account.

How long does a typical rollover or buyback take?

Timelines can vary: trustee‑to‑trustee rollovers and transfers often take 2–6 weeks depending on the source account and custodian responsiveness. Buybacks and liquidations typically complete in a shorter window but depend on verification, shipping (if physical delivery is involved), and settlement processes—ask Goldco for current turnaround estimates for your situation.

How does Goldco’s buyback price compare to market prices?

Buyback prices are usually tied to spot market prices but adjusted for dealer spreads, product premiums, and any applicable fees. Expect buyback offers to be close to market value for widely traded coins and bars, while specialty items may have wider spreads. Ask for a sample buyback quote to compare against spot when evaluating liquidation options.

Is Goldco Right for You?

Deciding whether to use Goldco depends on your retirement goals, account size, and appetite for holding physical precious metals. Goldco can be a strong match for investors who want professional support to move part of their retirement savings into gold and silver while keeping tax-advantaged IRA status.

- Are concerned about economic instability, inflation, or currency devaluation

- Want to diversify retirement accounts with physical gold or silver

- Have around $25,000 (typical IRA minimum) available to allocate to a precious metals IRA

- Value educational resources and dedicated customer support during rollovers and purchases

- Prefer tangible assets (coins, bars) as part of a diversified savings strategy

That said, precious metals IRAs are generally one component of a diversified portfolio. They may not be ideal if you need regular income from investments, prefer very low minimums, or want a wide menu of metals beyond gold and silver.

Next steps

- Get a free consultation to discuss whether a gold IRA fits your retirement plan.

- Request a current price quote and a detailed fee schedule (setup, custodian, storage).

- Compare product premiums for coins and bars and ask about buyback terms if you plan eventual liquidation.

- Consult a tax advisor about IRA distributions and any tax implications before taking physical possession.

If you want more information, Goldco’s educational resources and free guide can help you evaluate options and the rollover process.

Take the Next Step

Request Goldco’s step-by-step rollover guide or check current offers (for example, qualifying free silver promotions). Confirm eligibility and dates with your representative.

Leave a Reply